Floods hit banana prices, national economic output

Grocery prices are forecast to spike across the country as the impact of the north Queensland floods spreads beyond drenched tropical communities.

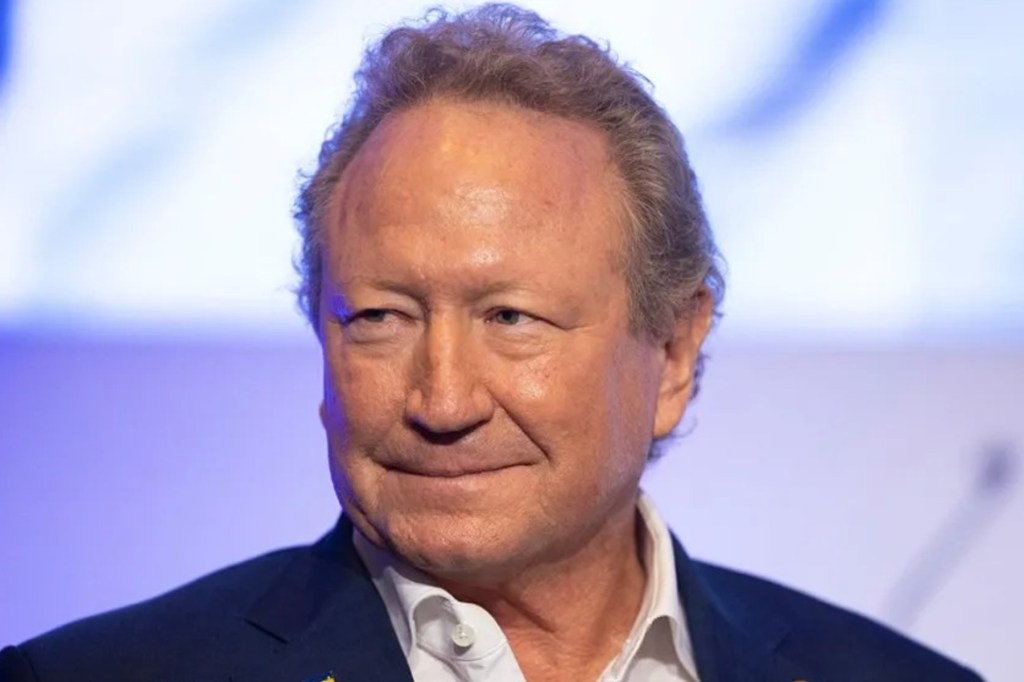

The devastating floods, which have claimed two lives in the so-called Sunshine State, have hit banana and sugar supplies, which will have a minor impact on prices, Treasurer Jim Chalmers said.

Treasury estimates up to 20 per cent of Australia’s banana crop could be affected by the disaster, as damage to road networks hampers supply chains.

“We know that the flood-affected region accounts for about 4 per cent of agricultural production in Australia,” Chalmers said on Tuesday.

“You can see that there might be quite narrow but significant impacts on some goods like bananas and sugar, but we don’t expect the overall impact on inflation to be substantial in aggregate.”

You might like

However, the economic cost and hit to the federal budget also worry the government.

Initial estimates from Treasury reveal lost economic activity as a result of the floods will amount to a 0.1 per cent reduction in March quarter gross domestic product, or output.

“That might not sound like a lot, but at a time when growth is not especially thick on the ground in our economy, that is not inconsequential,” Chalmers said.

“Obviously, as we always see with these sorts of events, there’s typically a bounce back in subsequent quarters, which comes from the rebuilding effort.

Stay informed, daily

“But in the context of an economy, which is already quite soft, another 0.1 per cent of activity in the quarter we’re in now will make a difference.”

Australia’s economy grew at a subdued 0.3 per cent in the September quarter and 0.8 per cent over the year, which was the lowest annual growth rate in decades.

Chalmers promised a “serious financial commitment” to help flood-hit communities recover and rebuild.

While the hit to growth will be felt in the national economy, the localised nature of the flooding means it should not have a major impact on consumer confidence levels.

The Westpac-Melbourne Institute consumer sentiment index edged up 0.1 per cent to 92.2 points in February, stalling a material recovery in consumer mood over the second half of 2024, Westpac head of Australian macro-forecasting Matthew Hassan said.

Consumers remain cautious, with household finances still stretched, but there’s rising optimism about the prospects for family finances given increased confidence about interest rate cuts.

“Overall, the mix suggests there may have been a larger than normal financial ‘hangover’ from the Christmas period and that many are still struggling with cost-of-living problems,” Hassan said.