Auditor-General warns that budget surplus is at risk and debt could rise

A report into the state economy by the Auditor-General has warned forecast net operating surpluses are “at risk” and that major infrastructure projects could run over budget.

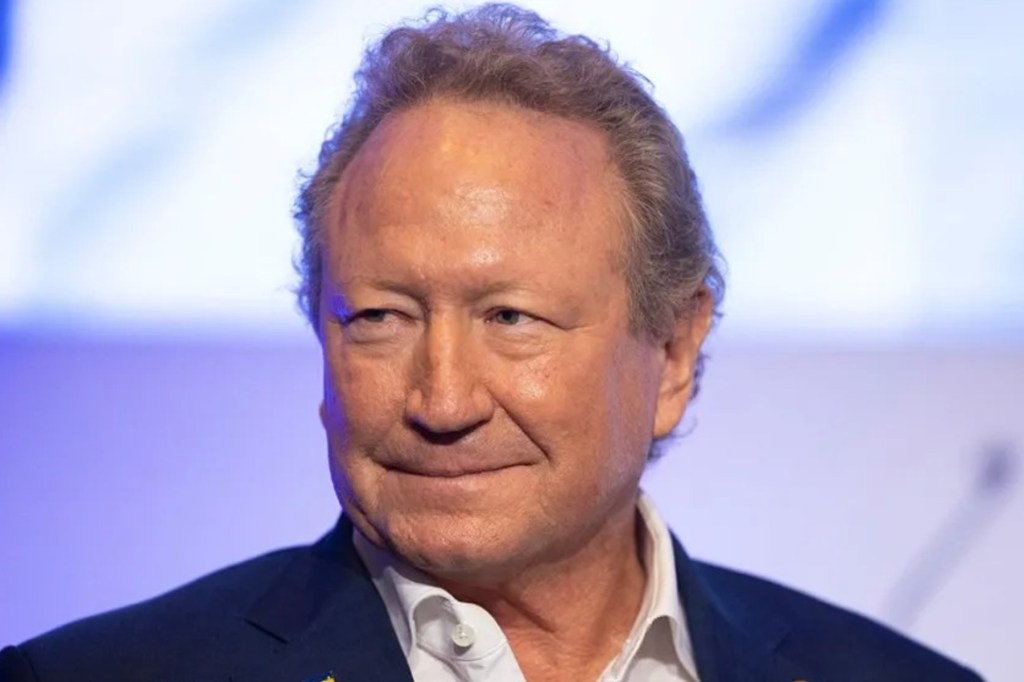

Auditor-General Andrew Blaskett’s latest report into the state’s finances, tabled in Parliament yesterday, warns that surpluses forecast in the 2024-25 State Budget may be “at risk” due to the current “challenging economic environment”.

Further, the Auditor-General warned cost of living pressures were creating a risk of downward revisions to budget forecasts for GST revenue and payroll tax.

SA Health’s budget was also highlighted as a challenge for the state government to manage, as was the “very large capital program” being undertaken in the state including the $15.3 billion Torrens to Darlington (T2D) motorway project and the new $3.2 billion Women’s and Children’s Hospital.

Rising debt is another future challenge for the state government to grapple with, the Auditor-General said, which may impact the state’s fiscal capacity to deliver the same level of services in the future.

The report considered the data provided in the 2024-25 Budget Papers, supplemented by information provided to the Audit Office of South Australia by the Department of Treasury and Finance.

In the 2024-25 State Budget, the government outlined its plans to achieve a net operating surplus in the general government sector every year in order to fund operating expenses from operating revenues.

The budget returned to surplus in 2022-23 following deficits racked up during the COVID-19 pandemic. An estimated $306 million in surplus was achieved in 2023-24.

The budget forecasts a surplus of $248 million in 2024-25, $458 million in 2025-26, $568 million in 2026-27 and $403 million in 2027-28.

But the Auditor-General said the current economic environment could put forecast operating net surpluses “at risk”, noting the 2024-25 surplus is expected to be met.

“There is ongoing volatility in GST receipts due to changes in South Australia’s share of the national GST pool, and challenging national economic conditions impacting consumer spending and the size of the pool. This could put GST budget forecasts at risk,” the report said.

“The South Australian Centre for Economic Studies’ June 2024 Economic Briefing Report indicates that the South Australian economy has recently shown a significant slowdown with key economic indicators showing weaker trends, including declining employment levels.

“This increases the risk of down revisions to budget forecasts for state taxation revenue, in particular payroll tax.”

You might like

The government will also face challenges in negotiating wage agreements, the Auditor-General warned, with negotiations planned for 2024-25 covering 73 per cent of general government sector employees and “are occurring in a period of high inflation”.

“The Adelaide Consumer Price Index increased by 7.9 per cent in 2022-23 and was estimated to rise by 4.8 per cent in 2023-24. This is likely to influence wage increases sought through enterprise bargaining negotiations,” the report said.

The Auditor-General added that government sector spending as a proportion of the state’s economy was “trending downwards”, with more money being spent on interest than services.

“An increasing proportion of that expenditure is expected to be for interest expenses rather than service delivery over the four years of the 2024-25 Budget,” the report said.

“This increasing interest burden may limit the state’s fiscal capacity and its ability to deliver the same level of services in the future, at the same time as critical service delivery areas are experiencing increasing demand and the state has below national average levels of spending on services.”

Treasurer Stephen Mullighan told InDaily that the economy was “well-positioned to withstand economic headwinds, coming in second in CommSec’s State of the States report released on Monday, after three consecutive quarters on top”.

“The Auditor General’s report highlights the pressures facing the South Australian economy, which is reflective of a slowing economy nationally. However, South Australia compares favourably to Victoria, New South Wales and Tasmania on key budget sustainability indicators,” he said.

“The State Government is committed to building a bigger, better health system and that comes at a cost, with a record $2.5 billion over 5 years allocated to SA Health in the State Budget, to ensure our health system is adequately resourced.

“We remain confident that forecast net surpluses outlined in the State Budget can still be achieved.”

Photo: Tony Lewis/InDaily

SA Health spending challenges

SA Health was highlighted by the Auditor-General as one risk to forecast net surpluses.

“If savings targets are not met, other areas of the Budget may need to be managed to deliver forecast net operating surpluses,” the report said.

This is due to recent growth in activity for public hospitals and difficulties SA Health has had in improving the efficiency of its service delivery.

SA Health breaching its allocated budget “could impact funding to other government programs and the efficiency demands made on other agencies”.

The organisation’s total actual expenditure has been above its original budget for the last 10 years (except in 2016-17), and since 2021-22 the overrun has trended above 7.5 per cent.

“Actual SA Health expenditure increased by $1.539 billion (21 per cent) between 2020-21 and 2023-24,” the report said.

“The 2024-25 Budget estimates that it will only grow by $613 million (7 per cent) between 2024-25 and 2027-28.”

Stay informed, daily

The importance of SA Health coming under budget was highlighted by the Auditor-General’s report, which noted that its savings targets will progressively increase and exceed the estimated net operating balance for the government sector by about $60 million by 2027-28.

“This highlights the importance of SA Health meeting its savings targets to ensure forecast net operating surpluses are achieved, particularly in the later years of the forward estimates,” the report said.

“If SA Health continues to not meet its savings targets, the SA Government may need to manage the Budget in other areas to deliver its forecast net operating surpluses.

“This could impact funding to other government programs and the efficiency demands made on other agencies.”

A render of the T2D project via the SA Government.

Expensive megaprojects risk budget overruns

The state government is currently building two megaprojects in South Australia: the $15.3 billion Torrens to Darlington (T2D) motorway project and the new $3.2 billion Women’s and Children’s Hospital.

The Auditor-General warned there were “several risks attached to the SA Government’s very large capital program”, such as the delivery of projects on time and on budget given construction industry capacity and skills constraints.

“Even small percentage budget overruns could have a significant impact on the state’s overall financial position, including increased net lending deficits and net debt,” the report said.

“As an example, a relatively small budget overrun (based on past experience with transport infrastructure projects in South Australia) of 10 per cent would amount to $1.54 billion for the T2D project.”

The Auditor-General described the risk of cost overruns and project delays as “high” given “the inherent challenges in managing very large-scale infrastructure projects in which the State has limited experience” and “construction industry capacity constraints and skilled labour shortages in South Australia”.

The report cited Infrastructure Australia’s analysis of the national construction workforce which found that “South Australia’s labour shortages are projected to progressively increase from October 2024 and peak in March 2027”.

“Infrastructure Australia notes that factors such as rising costs of labour and materials, labour and skills shortages and disruptions or under-supply of materials have been identified by multiple Australian states as a major cause of cost increases and delays to delivering infrastructure projects, and are an ongoing challenge,” the report said.

“The SA Government has limited experience in managing and delivering projects of the scale and complexity of the T2D project and new Women’s and Children’s Hospital.

“These projects are more likely to face increased risks due to their size, higher complexity, longer time frames and unique characteristics.”

Rising debts pose a problem

Net debt in South Australia is forecast to reach $44.2 billion by 2028, largely due to increased borrowing to fund the megaprojects.

The Auditor-General warned that if debt was not managed at a sustainable level it would “pose a risk to future economic stability and prosperity”.

“The SA Government has set a fiscal target in the 2024-25 Budget to achieve a level of net debt that is sustainable over the forward estimates, but it has not set a quantifiable measure to assess its performance against this target,” the report said.

“It has also not set a specified time frame within which it aims to stabilise and reduce net debt, which some other states have done.”

Further, net debt is projected to rise from 97 per cent of revenue in 2023-24 to 132 per cent of revenue in 2027-28: “expected to be higher than all other states except Victoria and New South Wales across the four years of the 2025-25 Budget”.

It will also rise to 25 per cent of gross state product by 2028, trending upward.

“The Commonwealth Parliamentary Budget Office considers a sustainable fiscal position to be where net debt as a proportion of GSP is expected to be stable or trend downwards over the long term,” the report said.