Regional house values continue to rise after interest rate cut

Homeowners in regional Australia have been given some good news, with house prices continuing to rise after the first interest rate cut in more than four years.

The latest home value figures show that regional prices continue to grow at a higher rate than their city counterparts.

And, despite more companies cracking down on work from home, regional prices in commuter areas and beyond are holding up.

Rate reaction

Regional housing conditions continued to show a stronger growth trend relative to their capital city counterparts in February according to CoreLogic.

Values across the combined regionals index rose 0.4 per cent over the month, compared to the 0.3 per cent monthly for city markets overall.

However, CoreLogic research director Tim Lawless said the improved housing conditions had more to do with more upbeat sentiment than any immediate lift in borrowing capacity due to the Reserve Bank’s interest rate cut.

You might like

“Expectations of lower interest rates, which solidified in February, look to be flowing through to improved buyer sentiment,” Lawless said.

“Along with the modest rise in values, we have also seen an improvement in auction clearance rates, which have risen back to around long-run average levels across the major auction markets.”

The median value for regional housing in Australia is $661,966 – while the combined capital city median is $896,613.

Sydney remains the most expensive city to buy a home, with a median dwelling price of $1.186 million.

The most expensive regional market is Australia is the Tweed Valley, which takes in Byron Bay, with a median dwelling value of $1.024 million.

Lower interest rates look to be flowing through to improved buyer sentiment. Photo: AAP

City to country

Lawless said internal migration was just part of the reason that regional home prices had continued to rise in Australia.

Stay informed, daily

“There is a second wind in regional population growth for internal migration that’s favouring the regions,” he said.

The latest figures from the Regional Australia Institute showed city-to-regional relocations are 19.8 per cent above the pre-Covid average and 1.8 per cent above the average at the height of pandemic lockdowns.

Lawless said while growth continued in coastal lifestyle and commutable areas, such as Wollongong and Newcastle in NSW, there was greater growth further away from capital cities.

“What’s happening now is the regions that are showing the strongest growth rates are much more rural,” he said.

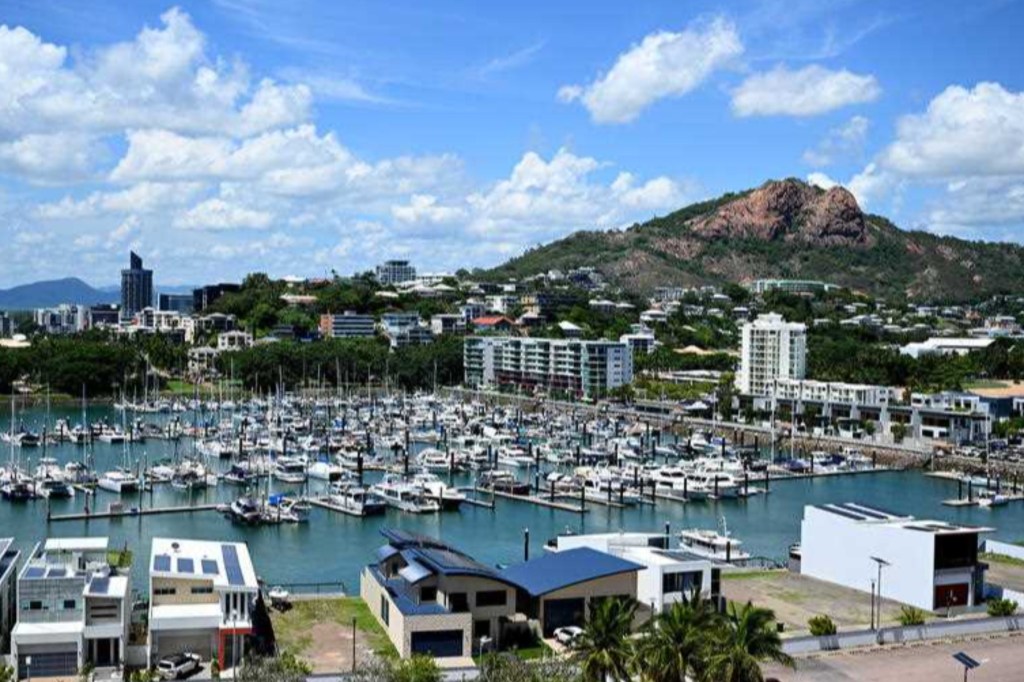

This included Townsville in Queensland, which had a whopping 24.4 per cent growth in home prices in February, along with mining-heavy regions in Western Australia, including the Pilbara and Goldfields.

Likewise, real estate group Ray White reported on strong regional house price growth.

This was particularly true in WA and South Australia, where regional house prices surged by 13.3 per cent and 11.3 per cent respectively in the past year, according to the Ray WhiteHouse Price Report.

Larger centres

In NSW, the Upper Hunter – which also has resource-based employment – led the state’s regions with an annual price rise of 8.2 per cent.

There was also strong growth in larger centres such as Newcastle and Dapto-Port Kembla in the Illawarra. Home prices in Newcastle were up 5.3 per cent in the past year, to $939,560.

Newcastle agent George Rafty of First National Newcastle City said February’s rate cut had “brought more optimism from buyers”.

He said while there was plenty of demand for properties in the million-dollar price bracket, there were fewer buyers for more expensive homes.

“Around $1.3 million up to $1.8 million there is still plenty of activity,” Rafty said.

“Once you are cross the $2 million mark, then there is a limited amount of buyers and it is a buyer’s market.”

This article was first published on View.com.au. Read the original here