Local tech firm to boost US capacity and expand into Europe

Having established a manufacturing facility in Ohio earlier this year, AML3D will more than double its US capacity and expand into Europe following a $30 million capital raise.

South Australian firm AML3D is looking to take full advantage of the demand for submarine and aerospace parts in the United States and will more than double the capacity of its Ohio facility following a new capital raise.

The company has also announced it will explore opportunities within the United Kingdom and European markets to establish a manufacturing facility in the region, where demand is similarly high for its 3D metal printing services.

The newly announced plans are supported by a $30 million capital raise, backed by existing AML3D shareholders and new institutional investors.

“This successful equity placement marks another significant milestone for AML3D with investor demand being extremely strong,” AML3D managing director Sean Ebert said.

“We are now in an excellent position to continue to rapidly advance our US expansion from Ohio, to take advantage of the demand from the US Department of Defence, whilst exploring the European markets by leveraging the backdrop of AUKUS.”

The company said it has been guided “to expect significant growth in US demand” following the US Department of Defense awarding a US$951 million contract to Blue Forge Alliance (BFA) to boost the US Navy’s submarine industrial base.

You might like

Further, AML3D said it was expecting a range of opportunities in the US energy sector and the Defence Aerospace sector, “specifically as part of the Manufacturing Licence Agreement with Boeing for the manufacture of aircraft parts”.

Earlier this year, the company achieved AS9100D accreditation, meaning it can now design, develop and manufacture aviation, space and defence products.

AML3D has already supplied six of its metal 3D printers to BFA and expects “a significant proportion of the recent award of US$951 million will be directed to accelerating adoption of advanced additive manufacturing technology”.

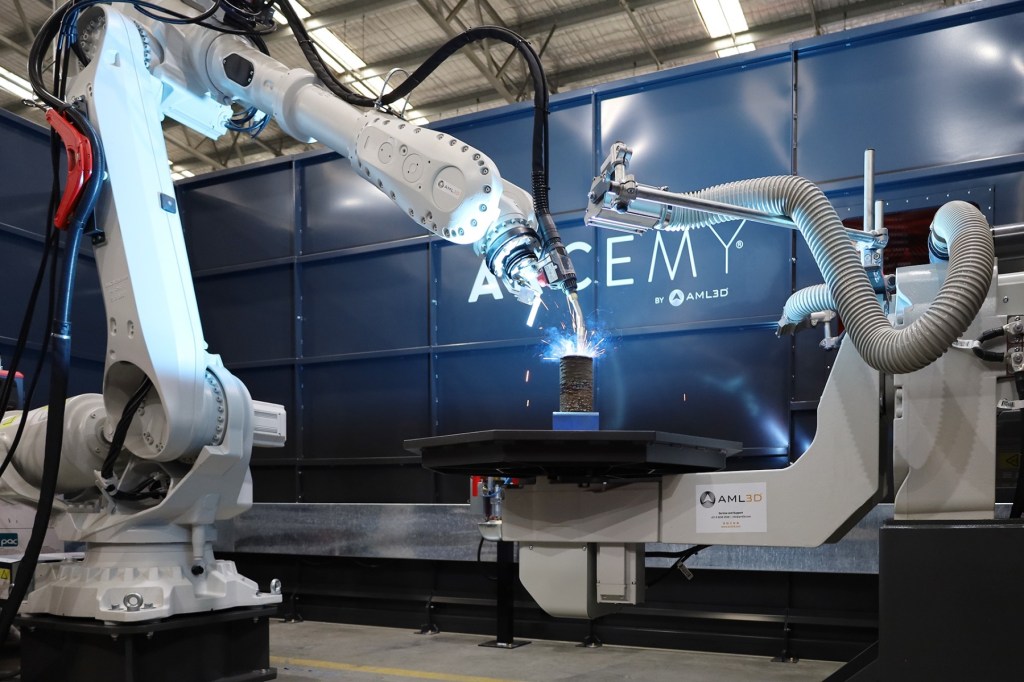

To meet this demand, the company is investing $12 million to more than double its Ohio manufacturing facility which will build and supply its ARCEMY printers.

It will initially install up to four additional ARCEMY systems for the production of manufactured parts into the existing US facility whilst looking to lease a second facility for the assembly of 3D printer systems for sale to customers and to support the US Navy defence contracting supply chain.

The company is also investing $3 million of the $30 million to continue developing its software and technology.

Stay informed, daily

“The decision in September by the US Department of Defense to award Blue Forge an additional US$951 million of funds is expected to help accelerate the adoption of AML3D’s ARCEMY technology,” Ebert said.

“My understanding is a reasonable proportion of the new funds will be directed to scaling up and integrating additive manufacturing into the US Navy’s Submarine Industrial Base.

“The completion of this $30 million capital raising provides AML3D with the funds to scale up our US operations to maximise this opportunity.”

AML3D US president Pete Goumas said he was excited to “see this surge in investment into additive manufacturing by the US Department of Defense, particularly into the Submarine Industrial Base where AML3D has been building its presence”.

“The US team is fully primed and ready to rapidly expand our operations and people to meet this new and potentially significant demand for our technology.”

In the UK and European markets, the company said it would establish a location for one ARCEMY system as a production and demonstration system for the market.

“The company is experiencing similar demand signals as it experienced in its entry to the US market and currently has a bid in for a system to a defence-related customer which it expects to secure,” AML3D said.

“The base in Europe will be a showcase Technology Centre for Europe and will be there to initially support the demand we are experiencing from the backdrop of AUKUS.”

AML3D will issue 157.9 million new fully paid ordinary shares at $0.19 per share to raise the $30 million, which is a 17.4 per cent discount to the company’s last closing price on 19 November.

Get more SA business news in your inbox each Monday morning with Business Insight. It’s free and informative.