SA wine continues to dominate in exports to China

Nearly all of Australia’s wine exports to China come from South Australia, as the value of shipments continues to rise since punishing tariffs were lifted.

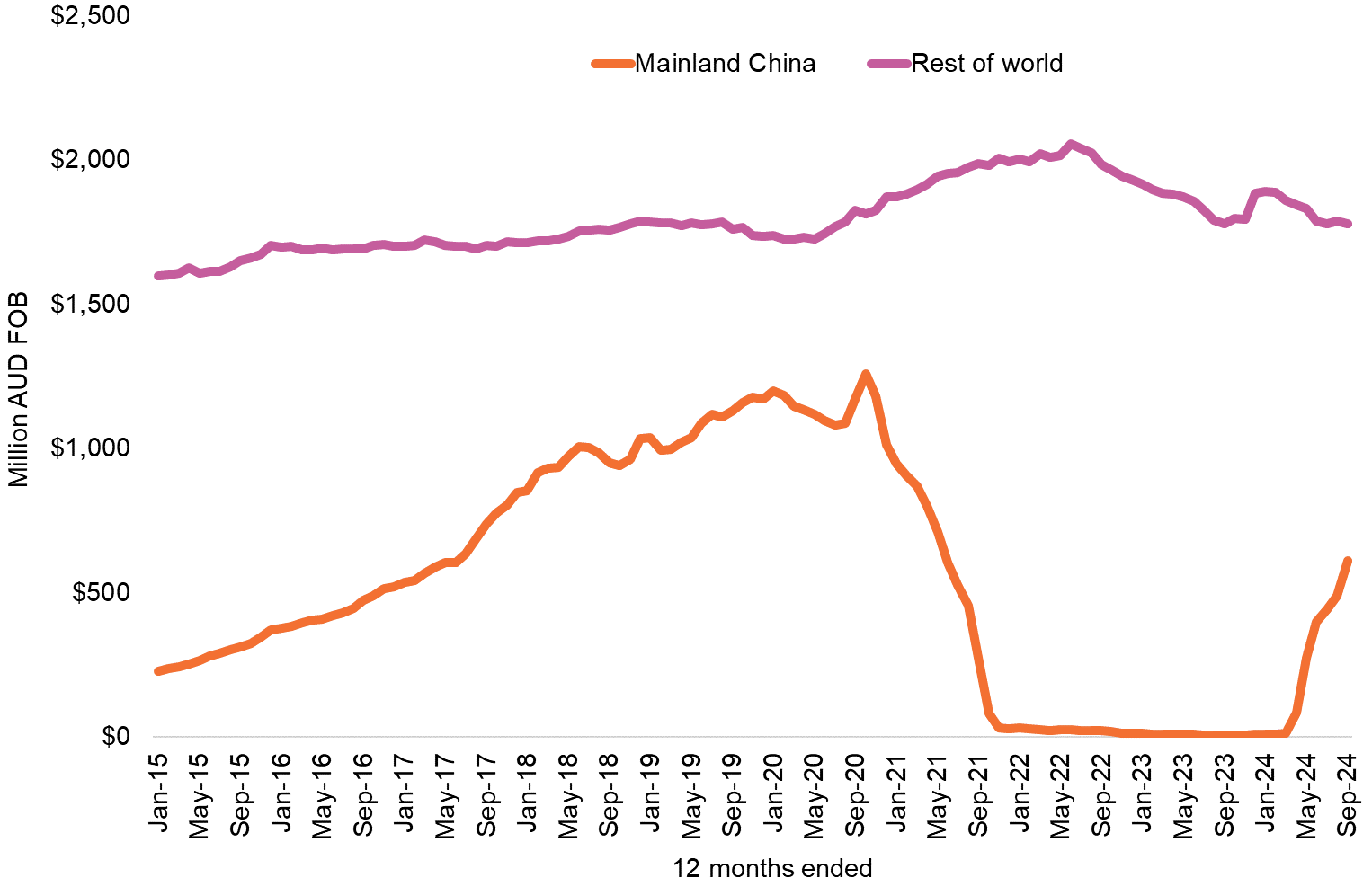

The value of Australian wine shipments to mainland China increased to $612 million in the 12 months to September 30 , of which $517.4 million (or 84.5 per cent) was attributed to South Australian wine.

The strong result for the state comes amid growing exports to the nation which dropped punitive tariffs on Australian wine in late March.

China is Australia’s top wine export destination for the second quarter in a row – with the value of wine going into the country almost double that exported to the second-largest buyer: the United Kingdom ($362 million – up 3 per cent).

Further, the value of South Australian exports was $1.2 billion in the 12 months – which is half of the entire $2.4 billion export value of Australian wine as a whole.

The export value of Australian wine was up 33.9 per cent in the year and by 7 per cent in volume to 643 million litres according to the new Wine Australia Export Report, released today.

The organisation said the national levels were the highest since the 12 months ended August 2021, with growth driven by the re-entry of Australian wine into China.

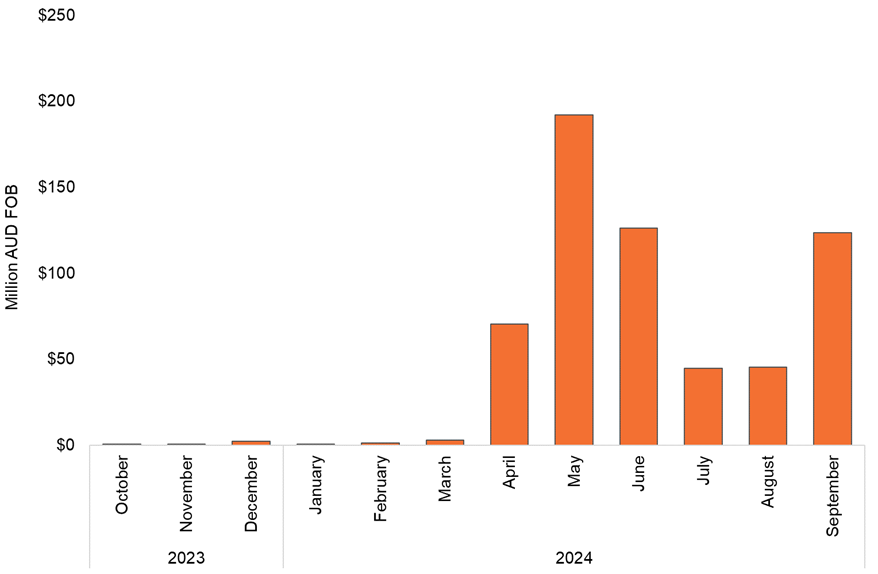

The value of wine exports to China in the September quarter was smaller than the June quarter in both volume and value, but still significant totalling 27 million litres worth $214 million.

You might like

But China is predominantly buying premium wine, explaining the high export value compared to the fact that it represents just 9.1 per cent of total volume sent overseas, meaning China is unlikely to be the silver bullet solution to the ongoing red wine glut crisis.

Of the 927 businesses exporting Australian wine to mainland China during the 12 months ended September 2024, the top ten exporters by value contributed 68 per cent of the total value and 38 per cent of total volume.

“While the export figures to mainland China are very positive, the impact on total export value is much larger than volume due to the premium price point of most wine entering the market,” Wine Australia market insights manager Peter Bailey said.

“As such, this increase is unlikely to reduce the oversupply of red winegrapes in the warm inland regions.

“It’s important to note that shipments in these first six months are likely to be characteristic of re-stocking Australian wine after a long absence.”

Bailey said it would be some time until winemakers would understand how Chinese consumers were responding to Australian wine being back on shelves.

Stay informed, daily

“Export levels are not equivalent to retail figures, and it will take time before it is evident how Chinese consumers are reacting to having Australian wine back in market,” he said.

“Despite recent growth in exports, it is increasingly important to pursue market diversification and defend our share in other wine markets.”

Exports to all other destinations were stable in value at $1.78 billion, and declined in volume by 3 per cent to 585 million litres.

“The most significant decline in volume was in exports to the United States, with nearly all the loss in volume (21 million litres) being unpackaged wine, following a surge in unpackaged wine to the market throughout 2022 and the start of 2023,” Bailey said.

“Exports to Canada stabilised in value as the decline in unpackaged wine eased and exports with an average value of $7.50 and above increased by 28 per cent in value.

“In Europe, growth in exports to the United Kingdom and Belgium more than offset declines to Germany, Denmark, and Spain – resulting in a small increase overall for the region.”

Red wine exports from Australia grew 16 per cent in volume to 356 million litres and 52 per cent in value to $1.74 billion, due to growth in exports to China.

Shiraz was the strongest performing varietal, up by 21 per cent in volume. Cabernet sauvignon and merlot exports also grew, up 11 and 5 per cent respectively.

White wine experienced a decline in volume exported by 5 per cent to 259 million litres, but increased in value to $549 million.

Chardonnay remains the number one Australian white variety, but exports of the drop declined by 3 per cent in volume to 143 million litres.

From South Australia’s point of view, the top variety exported globally was cabernet sauvignon, followed by cabernet blend, shiraz blend, and shiraz.

It is a similar trend to China, which prefers South Australian reds above all other varietals. The top-performing white export to China was chardonnay, which only represented $2.9 million of the total $411.5 million export value from SA.

Wine Australia said 58 per cent of Australian wine produced is exported to 113 destinations globally by 1,671 active exporters.