Final steps in international takeover of Adelaide miner

A nearly $400 million takeover of an Adelaide-based exploratory miner by an Indonesian group has taken the next step, as the proposal receives two key approvals.

Directors of Rex Minerals, the developer of an open-cut mine on the Yorke Peninsula, unanimously recommended in July that its shareholders accept a takeover offer from MACH Metals Australia, which valued the firm at $393 million.

In an announcement to the ASX yesterday, Rex said shareholders had voted in favour of the acquisition, with 98.3 per cent (505) of voting shareholders in favour. The threshold for the vote to pass was 75 per cent.

MACH Metals, a subsidiary of Indonesian conglomerate Salim Group, has proposed to acquire all Rex Minerals shares it does not already own at $0.47 per share.

The offer price implies an equity value in the Rex Minerals of $393 million and represents a 79 per cent premium for shareholders.

The company also announced yesterday that MACH Metals had received the confirmation required under the Foreign Acquisitions and Takeovers Act that the Commonwealth Government had no objection to the acquisition.

You might like

Following the two approvals, the acquisition must gain approval from the Federal Court of Australia, with a court date set for October 15.

Rex Minerals said if approval was given, it would lodge a copy of the court’s orders with ASIC on October 16, at which time the scheme would become effective.

Rex said subject to the scheme becoming effective on that date, it would suspend trading on October 16, and the scheme would be implemented on October 30.

In July, Rex said the offer had been received in a competitive global partnering process, with a focus on the $854 million funding and development pathway for its Hillside project in South Australia, 12km south of Ardrossan.

Stay informed, daily

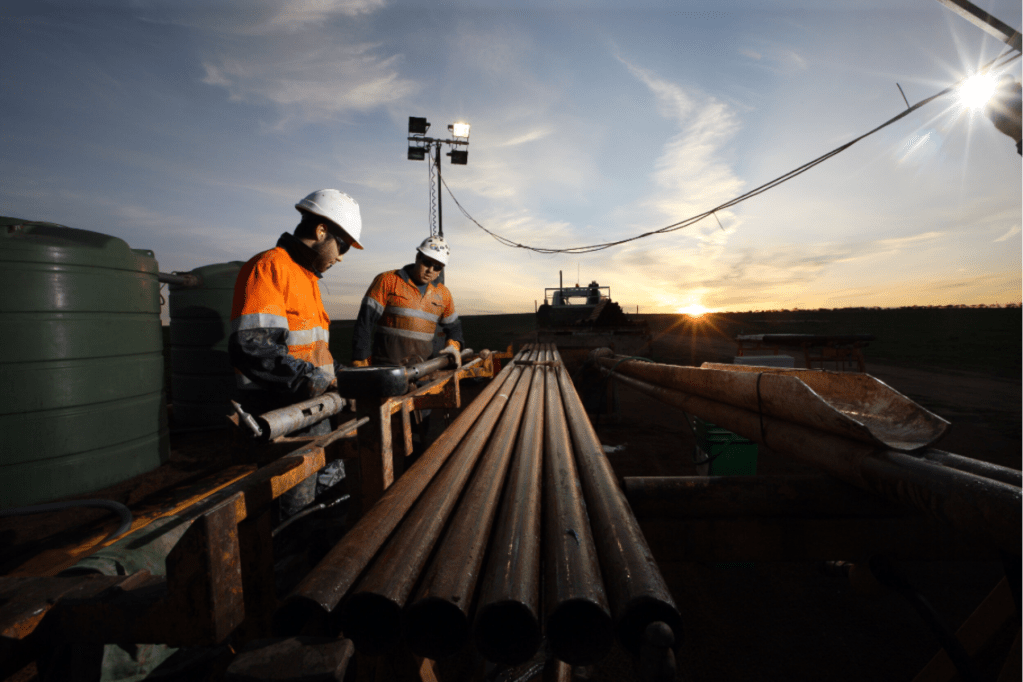

Once operational, Hillside will be an open pit mine on an undeveloped copper and gold site and is dubbed the “re-birth of the copper industry on the Yorke Peninsula” by Rex Minerals – the 29th largest company in the state according to the 2024 South Australian Business Index, after rising 23 spots from 2023.

The Hillside project has faced community opposition, with locals raising concerns about mining exploration rules on productive farmland, and Black Point shack owners opposing the plan as well.

A select committee into land access provisions for mining companies under the state Mining Act was established in 2021 following community response.

The committee delivered six recommendations, including that the Department for Environment and Water undertake mapping of existing land use and attributes to develop standalone planning legislation.

In July, Rex CEO Richard Laufmann said the proposed acquisition was an opportunity for shareholders to “realise their investment at a 10-year historical share price high”.

“This transaction also represents a more certain outcome for wider stakeholders in Hillside, including the local community, the South Australian government and Rex employees who will benefit from the significant financial strength and proven track record of MACH to deliver the successful development of Hillside,” Laufmann said.

“The South Australian Government has been a leader in Australia in support of decarbonisation and copper development. The successful development of Hillside will very much align with their strategy.”